Submission to the Productivity Commission’s Inquiry into The Worst Public Policy Decision of the 21st Century Thus Far (aka “the WA GST deal”).

Australian Society and Politics, Economic Policies, The Australian Economy | 5th January 2026

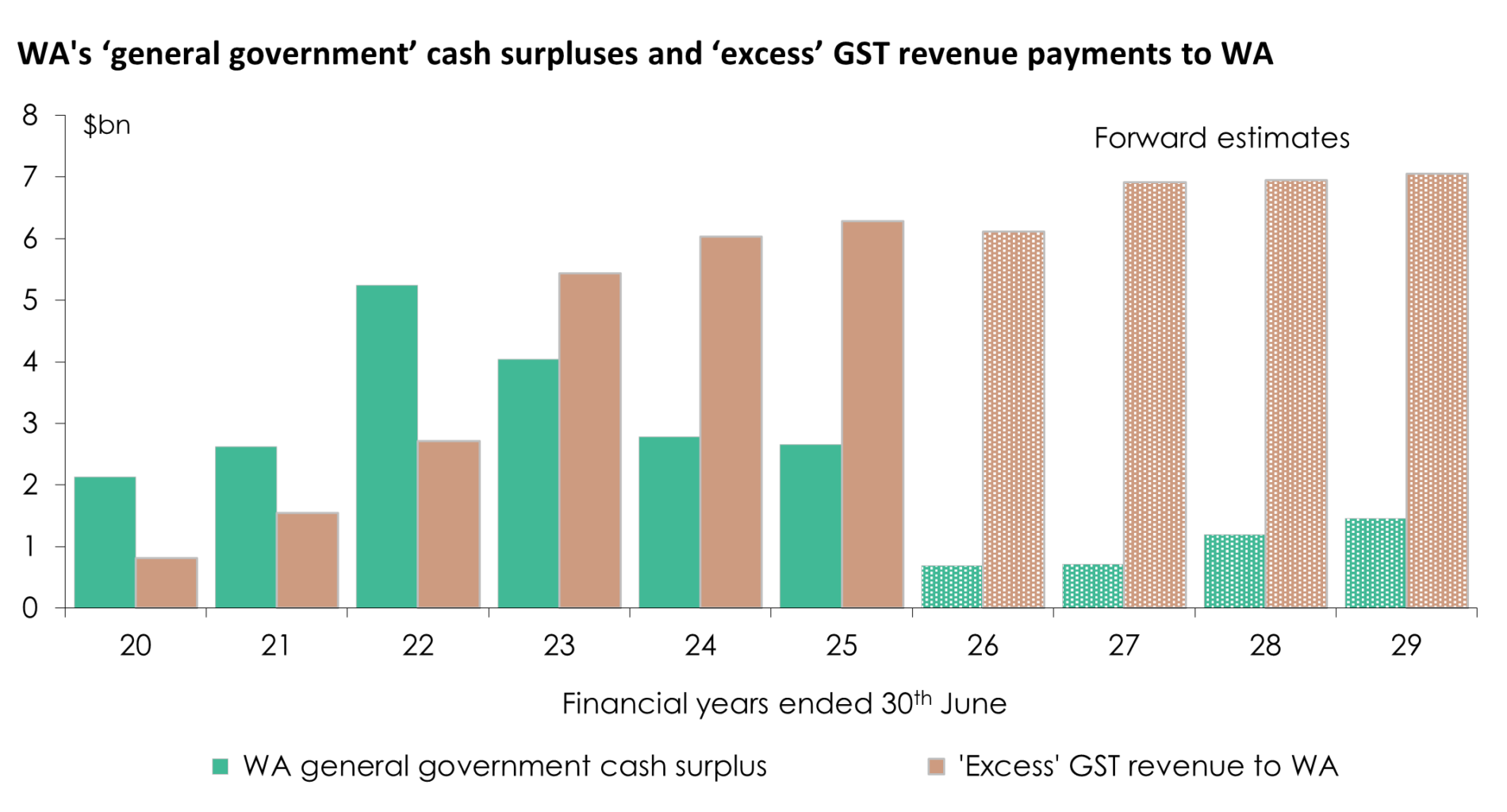

The Productivity Commission has been asked to inquire into what I’ve called The Worst (Australian) Public Policy Decision of the 21st Century Thus Far – namely, the Orwellianly-titled Treasury Laws Amendment (Making Sure Every State and Territory Gets Their Fair Share of GST) Act 2018, legislated by the Morrison Government (with the support of the then Labor Opposition), and extended by the current Albanese Labor Government. These changes undermined the principles which had governed the distribution of ‘untied’ financial assistance from the Federal Government to the governments of Australia’s states and territories (which since 2000-01 has taken the form of the revenue from the GST introduced that year) since the 1930s, in order to give Australia’s richest state, Western Australia, a bigger share of the GST than it would have received had that legislation not been enacted. Since then, WA has received $20 billion by way of ‘excess GST revenues’, and stands to receive a further $23 billion over the next four years – despite over the same period having raked in $105 billion in mineral royalty revenues.

Here’s my submission to this Productivity Commission inquiry – which is due to report by the end of this year. My submission argues that the Productivity Commission cannot credibly find that the changes enacted by the 2018 legislation are working “efficiently, effectively and as intended” (which the Terms of Reference ask them to consider) – and recommends that the Commission consider how the long-standing objectives of what in Australia is called “horizontal fiscal equalization” (of the capacity of the states and territories to provide similar standards of public services to their populations whilst levying on them similar levels of state taxes and charges) can be achieved via a simpler, more comprehensible, more transparent and more predictable system than the one which has evolved over the past ninety years.

2026-01-05 PC GST Distribution Inquiry Submission